The Ancient Protein Clock That Ticks Without DNA

TL;DR: The longevity economy represents a $38 trillion opportunity as global aging creates new markets across healthcare tech, senior housing, fintech, travel, and age tech. Success requires patience, empathy, and understanding that solving aging-related challenges isn't a niche - it's the new mainstream.

By 2050, the world will have more people over 65 than under 15 for the first time in human history. This isn't just a demographic curiosity - it's the biggest economic transformation since the industrial revolution. The longevity economy, valued at over $7.6 trillion in the US alone, is creating entirely new markets while forcing existing industries to reinvent themselves. Entrepreneurs who understand this shift are already building billion-dollar businesses, while those who ignore it risk becoming obsolete.

We're witnessing something unprecedented. Life expectancy has jumped from 47 years in 1950 to over 73 years today, and it's still climbing. But here's what makes this different from past demographic shifts: it's happening everywhere, and it's happening fast.

The Asia-Pacific region is aging so rapidly it's creating what economists call a "less sudden but equally disruptive health shock" compared to pandemics. In Japan, adult diapers already outsell baby diapers. South Korea's fertility rate has plunged to 0.72 - the lowest in recorded history. China's working-age population is shrinking by millions each year.

This isn't a problem. It's a $38 trillion opportunity.

The numbers tell a compelling story. By 2030, people over 60 will outnumber children under 10 globally. In Europe, one in three people will be over 65 by 2050. The US already has 10,000 people turning 65 every single day - a trend that won't slow until 2030.

But here's what most analysts miss: older adults aren't just living longer, they're staying healthier, wealthier, and more active than any previous generation. They control 70% of disposable income in the US. They're traveling more, spending more, and demanding products that simply didn't exist a decade ago.

The healthcare sector is undergoing its most dramatic transformation in a century, and aging populations are the catalyst. We're not talking about incremental improvements - we're talking about complete reimagination of how care gets delivered.

Artificial intelligence is rewriting the economics of health by making early detection, diagnosis, and treatment exponentially more efficient. Teton.ai just raised $20 million to reinvent elderly care using AI that can predict falls, detect cognitive decline, and coordinate care across multiple providers. CareCam in Singapore is using AI-powered digital wound care that reduces healing time by 40%.

The telehealth explosion isn't slowing down - it's evolving. Remote patient monitoring devices are now sophisticated enough to catch heart problems weeks before symptoms appear. Wearables have moved beyond step counting to tracking blood oxygen, ECG patterns, and even early signs of Parkinson's disease.

But the real money is in preventive care platforms. Companies are building ecosystems that integrate genetic testing, AI health coaching, and personalized nutrition to keep people out of hospitals entirely. The longevity market is projected to grow at 8.3% annually through 2035, hitting $44.2 billion.

Here's the kicker: if digital health tools remain confined to big cities or priced beyond reach, their benefits will bypass those who need them most. The companies that crack equitable access will dominate this space.

While US investors have been pouring money into senior living for years, Europe is just waking up to what might be the continent's biggest real estate opportunity of the decade.

The baby boomer wave hitting Europe's housing market is creating unprecedented demand for age-appropriate housing. But here's the problem: Europe has a massive supply shortage. The UK alone needs 120,000 additional senior housing units by 2030 just to meet baseline demand.

Smart developers are rethinking what "senior housing" even means. Forget nursing homes with fluorescent lighting and antiseptic smells. The new generation of senior living looks more like boutique hotels with wellness centers, coworking spaces (yes, really), and farm-to-table dining.

In the US, senior living cap rates are compressing and deal volume is surging as investors recognize the sector's resilience. Even in markets experiencing broader real estate slumps, senior housing properties are seeing prices soar past inflation.

The innovation isn't just in the buildings - it's in the business models. Hybrid care facilities that blend independent living with on-demand medical services are capturing premium rents. "Aging in place" technology platforms are creating entirely new categories of home modification services.

Here's a mind-bending fact: someone who retires at 65 today might live another 30 years. Traditional retirement planning - built on the assumption of maybe 10-15 years of post-work life - is completely inadequate.

Fintech companies are rushing to fill the gap with products specifically designed for longevity. Reverse mortgages are getting a tech-enabled makeover, allowing retirees to extract home equity without the predatory terms that gave the industry a bad name. Longevity insurance - policies that only pay out if you live past 85 - is becoming mainstream.

But the real action is in wealth management platforms designed for the "new old." These aren't your grandfather's financial advisors. They're algorithm-driven services that rebalance portfolios based on health data, adjust spending recommendations using AI, and even factor in family longevity genetics.

Subscription-based healthcare savings accounts are emerging as a new category, letting people pre-fund future medical expenses with tax advantages that dwarf traditional HSAs. One platform reported 300% growth in 2024 alone.

The psychological shift is just as important as the financial innovation. People in their 60s and 70s aren't thinking about "running out the clock" - they're planning second careers, starting businesses, and making 20-year investment horizons. Financial products that treat retirement as an extended adolescence rather than a slow decline are winning massive market share.

Older adults are now the fastest-growing segment of global tourism, and they're completely reshaping the industry.

Rising demand for wellness tourism, eco-tourism, and digital-enabled travel experiences is creating billion-dollar subsectors that didn't exist five years ago. River cruises designed for seniors are booked solid two years in advance. "Voluntourism" programs that combine travel with meaningful work are exploding in popularity among 60+ demographics.

The leisure market overall is experiencing a renaissance. Analysis of generational consumption patterns shows that boomers are spending more on experiences than any previous generation at the same age. They're taking longer trips, staying in better hotels, and they're willing to pay premium prices for accessibility and comfort.

Adventure travel companies are adapting their offerings for older but active clients. Think hiking Machu Picchu with porters who carry your gear, or photo safaris with specialized vehicles that make wildlife viewing easier on aging joints. These aren't watered-down experiences - they're thoughtfully designed adventures that acknowledge physical realities without sacrificing authenticity.

Technology is enabling experiences that were impossible before. VR travel experiences let people with mobility limitations "visit" destinations they can't physically reach. AI-powered trip planning services create custom itineraries that factor in medication schedules, dietary restrictions, and energy levels.

Age Tech investment trends for 2025 reveal a sector that's gone from fringe to mainstream in less than three years. We're talking about everything from robotics that help with daily tasks to AI companions that combat loneliness.

The standout innovations? Social connection platforms designed specifically for older adults are seeing explosive growth. These aren't just simplified versions of Facebook - they're reimagined digital spaces that prioritize meaningful interaction over engagement metrics.

Medication management systems that use computer vision and IoT sensors to prevent dangerous drug interactions are becoming standard in assisted living facilities. Fall detection that can differentiate between actually hitting the floor and just bending down to tie your shoes is finally reliable enough for widespread adoption.

But perhaps the most promising subsector is "cognitive fitness" platforms. Think of them as Peloton for your brain - gamified cognitive training that's actually backed by neuroscience research. Early data suggests these platforms can delay cognitive decline by years, and investors are taking notice.

Technology is fundamentally reshaping senior care by making it more proactive, personalized, and - crucially - more dignified. The companies succeeding in this space understand that older adults want agency, not surveillance.

Not everything in the longevity economy is roses and rocket ships. VC-backed longevity startups are facing a harsh reality: the wellness gold rush is colliding with actual business fundamentals.

Here's what's killing companies:

The regulation maze. Healthcare is one of the most regulated industries on Earth, and for good reason. But startups built by Silicon Valley veterans often drastically underestimate how long it takes to navigate FDA approvals, Medicare reimbursement, and state-by-state licensing requirements. What looks like a six-month path to market often turns into a three-year slog.

The sales cycle nightmare. Selling to healthcare systems and insurance companies isn't like selling software to tech companies. Decision cycles can stretch 18-24 months. You need clinical evidence, peer-reviewed studies, and reference customers before anyone will take a meeting.

The unit economics trap. Many longevity startups are trying to serve populations that, ironically, can't afford their products. Building for the mass market means accepting lower margins and slower growth than venture investors expect. Building for wealthy seniors means limiting your addressable market to maybe 15% of the aging population.

The companies surviving this shakeout share common traits: they started with a specific, solvable problem rather than a grand vision. They built in channels where customers already exist rather than trying to create new distribution from scratch. And they understood that in healthcare, trust takes years to build and seconds to destroy.

Government policy is simultaneously the biggest accelerator and the biggest brake on longevity economy growth.

The good news: productivity and growth in an aging society are becoming central policy priorities across developed nations. Tax incentives for age-friendly housing modifications are expanding. Medicare is slowly but steadily expanding coverage for preventive care and remote monitoring.

Japan and Singapore are leading the way with comprehensive national strategies for aging societies. Singapore's HealthierSG program provides subsidized preventive care to all residents over 40. Japan is testing entire "smart cities" designed from the ground up for aging populations, with everything from autonomous shuttles to AI health monitoring built into the infrastructure.

Europe is creating frameworks for cross-border elder care that could open up massive labor markets for caregiving professionals. The EU's new Digital Health Space initiative is standardizing health data portability across member states, making it easier for health tech companies to scale.

But bureaucracy remains a massive headwind. In the US, Medicare reimbursement rules are byzantine and frequently contradictory. Getting a new medical device approved by the FDA can take 3-7 years and cost tens of millions of dollars. Many potentially life-changing innovations die in the regulatory waiting room.

Smart entrepreneurs are working with regulators rather than around them, involving policy experts from day one and building compliance into their product development process rather than bolting it on later.

The longevity economy isn't playing out the same way everywhere, and that creates fascinating opportunities for cross-pollination.

Asia-Pacific: This region is aging faster than anywhere else on Earth, which means they're also innovating faster. The rapid aging of Asia-Pacific is creating economic and social pressures that are forcing radical experimentation. Multi-generational housing is normal, not novel. Robotics in elder care is decades ahead of the West. The cultural expectation of family caregiving is both a strength (built-in support networks) and a challenge (fewer market-based solutions).

Europe: Strong social safety nets mean less private sector urgency, but also more stable market conditions. The emphasis is on quality of life rather than just extending lifespan. European approaches to end-of-life care and "death with dignity" are influencing global conversations.

North America: Market-driven healthcare creates chaos but also rapid innovation. The sheer scale of the US market means successful products can reach massive audiences quickly. Canada's hybrid public-private system is becoming a testing ground for models that might work in other mixed economies.

Latin America and Africa: These regions are in the unusual position of dealing with both young populations in some areas and rapidly aging populations in urban centers. Solutions that work here need to be low-cost, low-infrastructure, and culturally adaptable. Mobile-first health platforms are leapfrogging traditional systems entirely.

What's clear: regional cooperation is becoming vital. Supply chains for medical equipment, knowledge exchange for best practices, and shared regulatory frameworks are making the longevity economy increasingly global. A strong economy cannot exist without strong health systems, and no single country can solve these challenges alone.

So you're convinced the longevity economy is the opportunity of the decade. How do you actually build a successful business here?

Start with a painful, expensive problem. Don't try to build a platform that does everything. Find one thing that's costing someone a lot of money or causing serious suffering, and solve it ruthlessly well. Medication adherence. Family caregiver burnout. Social isolation. Pick one.

Understand your true customer. In healthcare, the person using your product often isn't the person paying for it. Medicare might be your customer. Adult children buying for aging parents might be your customer. Get crystal clear on who writes the check, because that's who you're really selling to.

Build for dignity, not disability. The language and framing matter enormously. Products marketed as "for seniors" often fail. Products marketed as making life easier, more connected, or more independent succeed regardless of user age. Nobody wants to feel old. Everyone wants to feel capable.

Distribution is harder than product. You can build the best age tech in the world, but if you can't reach your customers, it doesn't matter. Partner with organizations that already have trust and access: AARP, senior centers, healthcare systems, retirement communities. Don't try to build your own channel from scratch.

Embrace the pace of healthcare. This isn't consumer internet where you can "move fast and break things." You're dealing with people's health, safety, and dignity. Slow down. Build trust. Prioritize reliability over features. The tortoise really does win this race.

Think global from day one. Aging is a global phenomenon. A solution that works in Tokyo might work in Toronto. Regulatory frameworks are harmonizing. Design with localization in mind from the beginning - it's much cheaper than retrofitting later.

If you want to thrive in this space, you need a specific, unusual combination of skills that few people have naturally.

Deep empathy with lived experience. You can't build for older adults without spending real time with them - not researching about them, but actually sitting with them, understanding their frustrations, observing how they interact with technology and healthcare systems. The best entrepreneurs in this space have personal connections to aging, often through caring for parents or grandparents.

Healthcare literacy. You need to understand how the healthcare system actually works - insurance reimbursement, clinical workflows, regulatory requirements, evidence standards. You don't need to be a doctor, but you need to speak the language well enough to collaborate with medical professionals as equals.

Patience with complexity. The longevity economy rewards people who can handle ambiguity, navigate bureaucracy, and think in timeframes measured in years, not months. If you need fast wins and instant gratification, this isn't your sector.

Cross-cultural competence. Aging is experienced differently across cultures. Family structures, attitudes toward independence, end-of-life preferences - these vary enormously. Building products that work across cultural contexts requires genuine curiosity about how other societies approach aging.

Technical chops in AI and data. Like it or not, AI is transforming the healthcare system from top to bottom. Understanding how machine learning can improve diagnostics, predict health events, or personalize care is quickly becoming table stakes. You don't need to be a data scientist, but you need data literacy.

The good news? Over the last decade, investors have backed over 20 unicorns that combine technology with human services, proving that the empathy-plus-automation model can scale. The machines will take millions of jobs, but they'll never lead like a human can - and nowhere is that truer than in caring for aging populations.

The longevity economy isn't coming - it's already here. Every day, demographic trends are creating new market opportunities that didn't exist yesterday. Every week, another startup raises millions to solve a problem that aging populations face. Every month, established companies that ignore this shift lose ground to more forward-thinking competitors.

The longevity sector is a strategic play for investors in a rapidly aging world. But it's also a strategic imperative for anyone who wants to build products that matter, serve markets that are growing, and create value that compounds over decades.

The entrepreneurs who win in this space won't be the ones chasing quick exits. They'll be the ones who understand that solving problems for aging populations requires patience, empathy, and a willingness to build for the long term. Ironically, success in the longevity economy requires thinking about longevity in business itself - sustainable growth, durable competitive advantages, and value that outlasts quarterly earnings cycles.

Healthcare is a central node in the long chain of the economic cycle. When healthcare breaks, productivity crumbles, trade stalls, and communities fracture. But when healthcare works - when we solve the challenges of aging populations with innovation, compassion, and smart business models - we create a rising tide that lifts entire economies.

The question isn't whether the longevity economy will reshape business. It already is. The question is whether you'll be part of building that future, or watching from the sidelines as the biggest economic transformation of our lifetime unfolds without you.

Within the next decade, you'll likely interact with multiple products and services designed specifically for longer lives. You might use AI health monitoring that catches problems before they become serious. You might invest in longevity-focused funds that generate returns by solving aging-related challenges. You might design your own career to include multiple "retirements" and reinventions.

The future isn't something that happens to us. It's something we build, one decision at a time. And right now, the most important decision might be recognizing that the longevity economy isn't a niche - it's the new mainstream.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

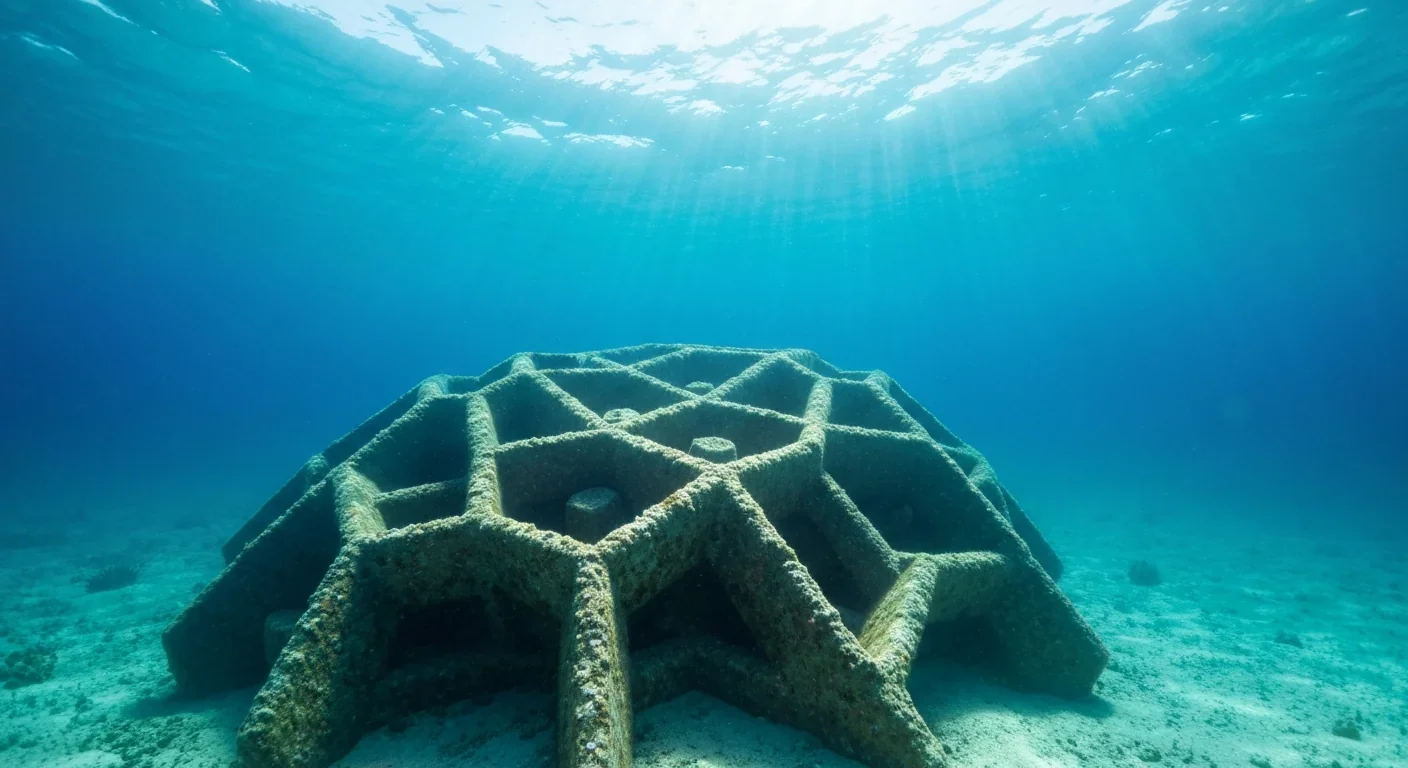

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

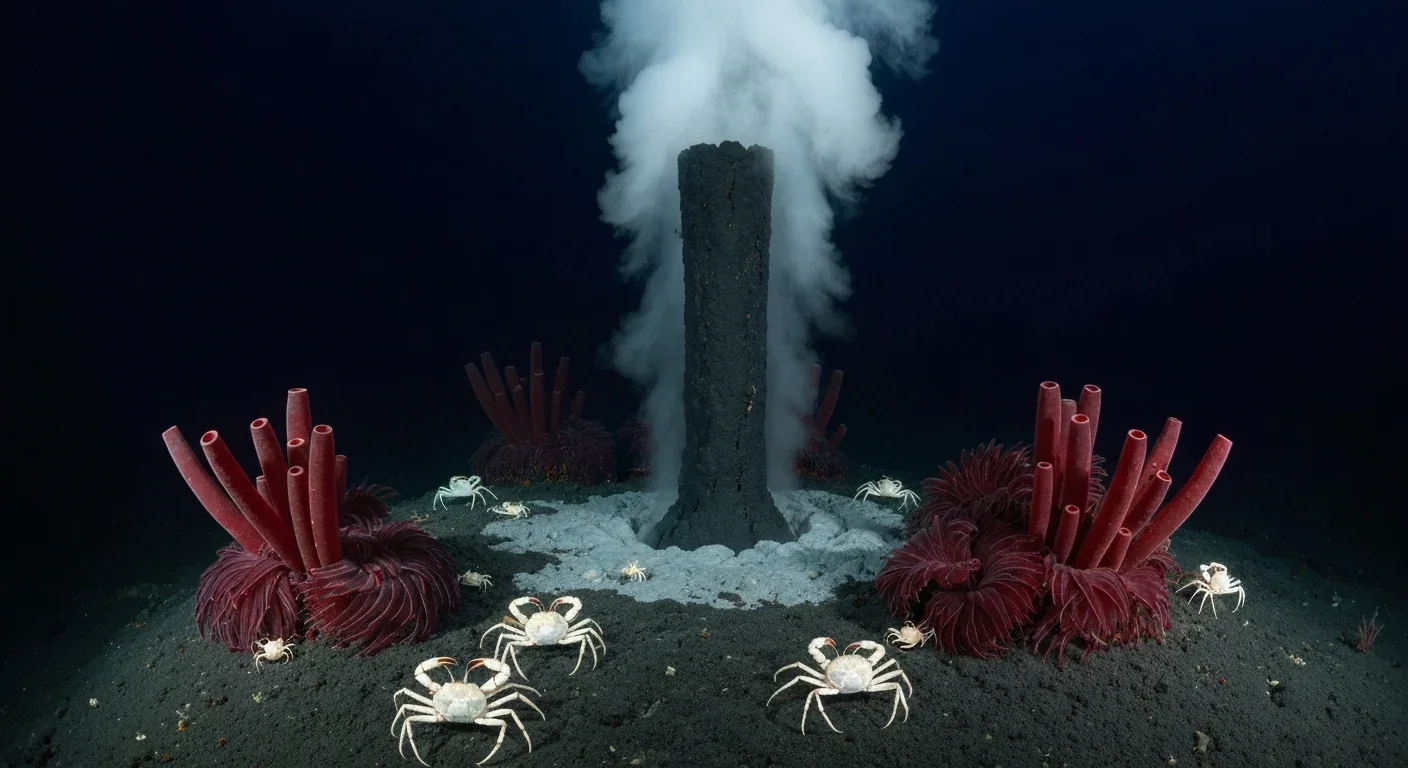

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

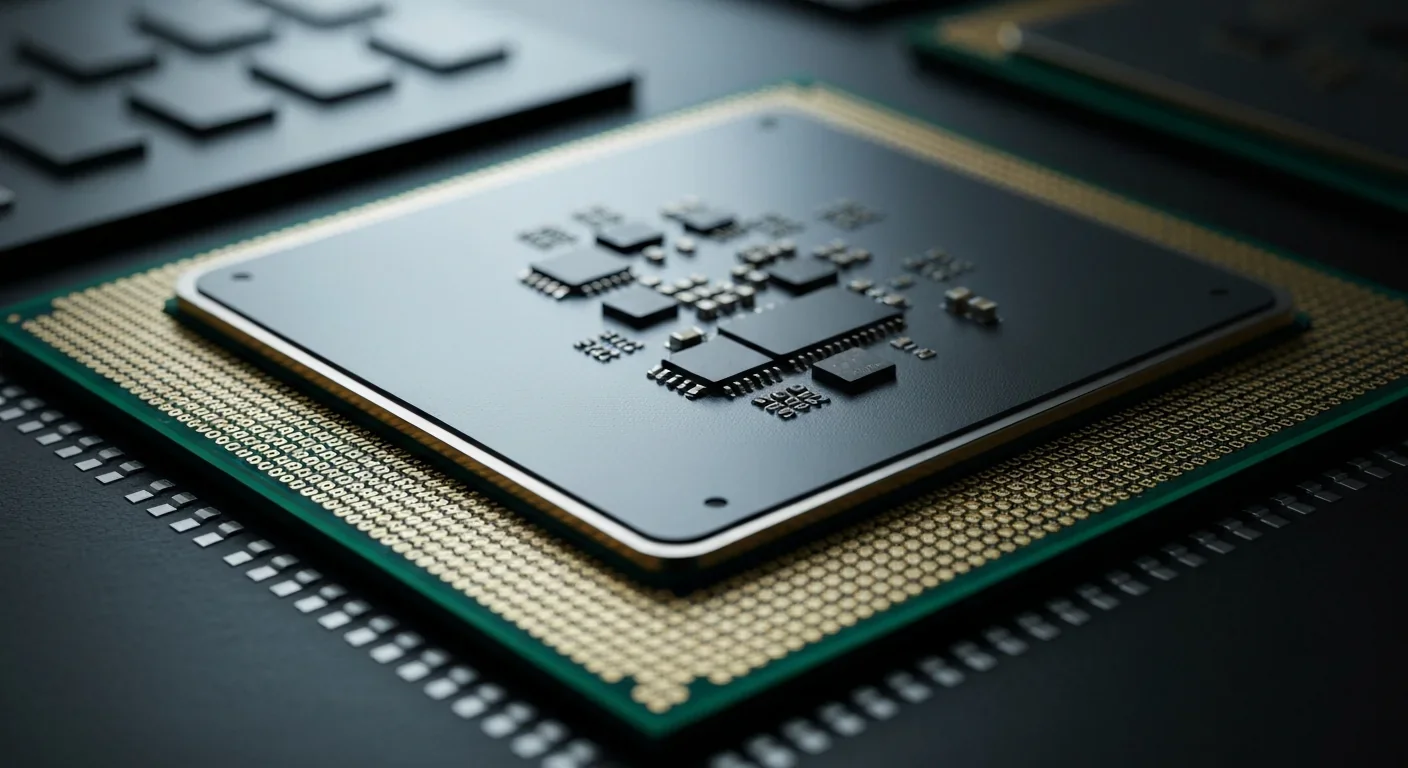

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.