The Ancient Protein Clock That Ticks Without DNA

TL;DR: The global longevity economy, driven by aging populations and projected to reach $63 billion by 2035, represents the largest wealth transfer in history. Businesses that understand this demographic shift and build for dignity, independence, and long-term value will capture trillions in opportunities across healthcare, finance, housing, technology, and leisure sectors.

By 2050, nearly every business model you know will be obsolete. Not because of AI, climate change, or geopolitics, but because of something far more predictable: we're getting older, and we're doing it faster than ever before. The global longevity market is projected to hit $63 billion by 2035, growing at 10.37% annually. But that figure wildly understates what's actually happening. We're witnessing the largest economic transformation in human history, and most companies are completely unprepared.

The numbers tell a story that should terrify and excite you in equal measure. By 2030, one in six people globally will be over 60. In wealthy nations, that ratio climbs to one in four. Japan already counts more people over 65 than under 15. South Korea's elderly population will triple by 2050. Even China, despite decades of one-child policy, will see its senior population surge past 400 million.

This isn't a crisis. It's a market signal louder than anything you'll hear this decade.

The WHO projects the global population of people aged 60 and over will double from 1 billion in 2020 to 2.1 billion by 2050. These aren't just passive consumers waiting out retirement. They're educated, experienced, and in many cases, wealthier than any previous generation of seniors. They expect products and services that match their capabilities, not their age.

What makes this transformation different from previous demographic shifts? Three things: longevity, wealth, and technology adoption. Today's 70-year-olds have more in common with yesterday's 50-year-olds. They travel, start businesses, invest aggressively, and increasingly, they refuse to act their age.

Understanding the longevity economy requires looking back at what happened when societies aged before. In 1900, life expectancy hovered around 47 years globally. By 2020, it reached 73. That's not just medical progress, it's a complete reconfiguration of the human life cycle.

Japan offers the clearest preview. When its birth rate collapsed in the 1990s and life expectancy soared, economists predicted disaster. Instead, Japan pioneered age-tech innovations that are now spreading worldwide: robotic caregivers, smart homes for independent living, and financial products designed for 40-year retirements.

The lesson? Aging populations don't destroy economies. They transform them.

Previous industrial revolutions centered on making things faster, cheaper, and more abundant. The longevity economy inverts that model. It's about personalization, experience, and relationship-building. Seniors don't want the cheapest product. They want the one that works for them, delivered by someone who understands their needs.

Europe learned this during its own aging transition. Nordic countries invested heavily in home care technology, allowing seniors to age in place rather than institutions. The assistive device market exploded, reaching $51.94 billion by 2034. What began as medical necessity became lifestyle preference.

The United States, characteristically, approached aging through a market lens. Senior housing investments are having their best year in decades, not as charity but as recognition that seniors command spending power that rivals any demographic. Americans over 50 control 70% of disposable income. They're not a niche market. They're the market.

The longevity economy isn't one industry. It's a complete reimagining of how we deliver healthcare, finance, housing, technology, and leisure to a population that's living decades longer than their grandparents.

Healthcare leads the transformation, naturally. But it's not just about treating disease. The elderly care services market will grow at 7.8% annually through 2032, driven by preventive care, wellness programs, and anti-aging therapies. Companies like Honor and Papa Health aren't building hospitals. They're building companion services, home health monitoring, and social connection platforms that keep seniors healthy longer.

The senior care product market tells an even more interesting story. Incontinence products, mobility aids, and daily living assistants are being redesigned with the same industrial design principles Apple uses for iPhones. Seniors won't buy products that scream "old person." They'll pay premium prices for products that enhance their independence while looking good doing it.

Finance is undergoing its own revolution. Traditional banks assumed seniors wanted safety above all else, steering them toward low-yield bonds and conservative portfolios. They were wrong. Research shows older adults are rapidly adopting fintech, seeking better returns, easier access, and tools that give them control over complex financial lives spanning multiple decades of retirement.

The challenge isn't getting seniors to use digital finance. It's building interfaces they can actually use. Companies that crack age-inclusive design, like the fintech platforms that prioritize accessibility, are capturing enormous market share. Voice banking, simplified dashboards, and fraud protection tailored to senior vulnerability points are table stakes, not features.

Housing represents perhaps the biggest opportunity. The math is simple: most homes weren't built for people who live to 90. Stairs become obstacles. Bathrooms become hazards. Isolation becomes a health crisis. Senior housing investors see record demand not just for traditional assisted living, but for co-housing, intergenerational communities, and age-friendly urban design.

The smartest developers aren't building "senior communities." They're building communities that work for all ages but excel for seniors. Universal design principles, like zero-step entries and wider doorways, appeal to young families with strollers just as much as retirees with walkers.

Technology was supposed to be for young people. Tell that to the 69 age-tech startups transforming how seniors interact with the digital world. Voice assistants, fall detection, medication reminders, and social platforms designed for meaningful connection over viral engagement are billion-dollar opportunities.

The elderly don't resist technology. They resist technology that makes them feel stupid. Companies that understand this distinction, building products with larger text, clearer instructions, and genuine customer service, are printing money. The assistive technology market expects explosive growth because it's finally building things people actually want to use.

Leisure and travel complete the picture. Senior spending patterns show they're the only demographic increasing discretionary spending year over year. They're not saving for college or paying mortgages. They're spending on experiences, hobbies, education, and adventure.

Cruise lines figured this out first, designing entire product lines around senior preferences. Now everyone from fitness studios to universities is building offerings for the 60-plus crowd. Elderhostel became Road Scholar and now serves hundreds of thousands of educational travelers annually. Luxury brands discovered seniors buy quality over trends, loyalty over novelty.

Some companies saw this coming. Others stumbled into it. Either way, the successful longevity businesses share common traits: they solve real problems, they respect their customers' intelligence, and they build for the long term.

Honor, the home care platform, raised over $100 million by recognizing that in-home care shouldn't mean isolated caregivers working for minimum wage. They built technology that connects professional caregivers with families, provides training and support, and treats aging as a normal part of life rather than a medical crisis. The result? Better outcomes, happier workers, and sustainable growth.

Papa Health took a different angle. They realized seniors weren't lonely because they were old. They were lonely because modern life is isolating. Papa matches college students with older adults for companionship, rides, and technology help. It's social connection as healthcare, and insurance companies are paying for it because it works.

The assistive device market shows similar innovation. Companies aren't just making walkers lighter. They're redesigning them entirely. Rollators with built-in seats, storage, and smartphone integration transform mobility aids from medical equipment into lifestyle products. Sales are soaring because the products are actually good.

Financial services are catching up. Firms building retirement planning tools that account for 30-year retirements, multiple careers, and complex family dynamics are capturing market share from traditional advisors. Fintech platforms that make financial inclusion a priority, not an afterthought, are finding enormous untapped demand.

Real estate developers are learning too. Communities that mix ages, provide amenities seniors actually use, like workshops and fitness centers, and design for long-term residence rather than end-of-life care are outperforming traditional models. The senior housing boom isn't about more nursing homes. It's about better living options.

Here's the part that should wake up every entrepreneur, investor, and business strategist: we're on the cusp of the largest wealth transfer in human history. An estimated $84 trillion will move from baby boomers to millennials over the next 20 years.

This isn't just inheritance. It's a complete restructuring of who controls capital and how they'll deploy it. Baby boomers accumulated wealth during the longest bull market in history. They own homes bought for five figures now worth seven. They have pensions, 401(k)s, and Social Security. Most importantly, they're living long enough to spend significant portions of that wealth themselves.

The spending power of seniors already shapes global consumption patterns. Americans over 50 account for more than half of consumer spending. They buy cars, technology, travel, and experiences at rates that dwarf younger demographics. They also invest heavily in health, wellness, and anything that extends their independence.

What happens when this wealth transfers to millennials? Conventional wisdom says it flows into different priorities: sustainability, experiences over ownership, technology-first solutions. But that misses the bigger picture. Millennials are becoming caregivers to aging parents while raising their own children. They're not abandoning the longevity economy. They're becoming its most demanding customers.

Smart businesses are preparing for this transition now. They're building products that appeal across generations, creating platforms that facilitate family care coordination, and developing services that address the sandwich generation's unique pressures.

Goldman Sachs research challenges the narrative that aging populations drag down growth. Instead, they argue that mature economies with older populations often show higher productivity, better resource allocation, and more stable growth. The key is building the right infrastructure and services to support this demographic shift.

The longevity economy isn't a free market free-for-all. Healthcare regulations, financial oversight, housing codes, and consumer protection laws all intersect in this space, creating complexity that can sink unprepared companies.

Healthcare regulations vary wildly by jurisdiction. What qualifies as a medical device in Europe might be a consumer product in the US. Home care licensing requirements differ state by state. Telemedicine regulations are still evolving. Companies entering this space need legal expertise, not just good intentions.

Financial services face even tighter scrutiny. Products targeting seniors trigger enhanced consumer protection requirements. Marketing must avoid predatory practices. Fee structures need transparency. Research into fintech risks shows seniors face unique vulnerabilities to fraud, algorithmic bias, and complex products they don't fully understand.

The solution isn't avoiding regulation. It's building compliance into product design from the start. Companies that treat regulation as a feature, not a bug, gain competitive advantages. They build trust faster. They attract institutional capital. They scale more sustainably.

Housing regulations present their own challenges. Zoning laws, building codes, and accessibility requirements create barriers to innovation. But they also create opportunities. Developers who master these regulations can move faster than competitors still figuring out compliance.

International expansion adds layers of complexity. Japan's approach to elder care differs fundamentally from America's, which differs from Germany's. Cultural attitudes toward aging, family responsibility, and institutional care vary enormously. Global companies need local expertise.

Ethical considerations matter too. Products that enhance independence are different from those that exploit vulnerability. Marketing that respects intelligence differs from that which preys on fear. Companies building for the long term recognize that ethical business practices aren't just good PR. They're essential for sustained growth in a market that values trust above almost everything else.

If you think age-tech means medical alerts and large-button phones, you're about a decade behind. The real innovation is happening in AI, robotics, biotech, and digital platforms that fundamentally reimagine what's possible for extended lifespans.

Artificial intelligence is being deployed to predict health issues before they become crises. Machine learning algorithms analyze patterns in daily activity, voice, and behavior to spot early signs of cognitive decline, depression, or physical health changes. These aren't invasive medical tests. They're passive monitoring systems that preserve independence while providing safety nets.

Robotics is moving beyond factory floors into homes. Not the humanoid robots of science fiction, but specialized devices that handle specific tasks: medication dispensing, fall prevention, and yes, companionship. Japan leads here, driven by necessity. Their robot nurses, automated care facilities, and AI companions are normalizing human-machine collaboration in elder care.

Biotechnology is pursuing the ultimate longevity solution: extending healthy lifespan itself. The anti-senescence therapy market is expected to reach $27.15 billion by 2024, funding research into cellular aging, senescent cell removal, and biological age reversal. This isn't science fiction. Clinical trials are underway.

Whether these therapies work remains uncertain. What's guaranteed is that wealthy seniors will pay enormous sums to try. The longevity market isn't just about living longer. It's about living better, longer. Products that deliver on that promise will find ready customers.

Digital platforms are connecting seniors in ways that reverse decades of isolation. Not Facebook clones with bigger fonts, but purpose-built communities around shared interests, local connections, and meaningful engagement. Research shows that social influence and digital literacy are key drivers of senior fintech adoption, suggesting that connected seniors become more, not less, technologically engaged over time.

Voice technology is eliminating barriers faster than any other innovation. When using a computer requires no manual dexterity, no visual acuity, and no technical knowledge, adoption skyrockets. Seniors are among the heaviest users of smart speakers, voice assistants, and audio interfaces. Companies designing voice-first experiences are tapping into enormous demand.

The conventional wisdom on aging populations goes like this: fewer workers, more dependents, economic stagnation, fiscal crisis. That narrative is crumbling under the weight of evidence showing aging populations don't necessarily reduce growth.

Research examining elderly populations and economic growth in the Americas finds complex relationships that defy simple predictions. In some contexts, aging populations correlate with higher per capita GDP. In others, they necessitate structural adjustments that ultimately strengthen economies.

The key variable isn't age. It's productivity. Economies that enable older workers to remain productive, that build industries serving senior needs, and that leverage accumulated experience and capital outperform those that sideline their elders.

Japan, again, is instructive. Despite the world's oldest population, Japan maintains the third-largest economy globally. How? By keeping seniors working longer, by building massive industries around elder care and age-tech, and by exporting those innovations worldwide.

Studies on aging and economic growth suggest that population aging can actually enhance economic sustainability through improved productivity, better resource allocation, and focus on quality over quantity. The effect depends on whether societies adapt or resist.

The Rothschild analysis of the silver economy frames aging as opportunity, not crisis. They identify trillions in investment potential across healthcare, real estate, financial services, and consumer goods. The firms positioning now will dominate for decades.

Developing nations face different challenges. Aging affects the Americas differently than Europe or Asia. Countries without extensive social safety nets, pension systems, or healthcare infrastructure will struggle. But they also have opportunities to leapfrog, adopting innovations proven elsewhere without legacy system constraints.

The effects of aging populations ripple through everything: labor markets, housing, consumption patterns, political priorities, and social structures. Businesses that understand these ripples can position themselves at leverage points where small innovations create outsized returns.

Enough analysis. If you're an entrepreneur, investor, or business strategist reading this, you're asking one question: what should I do about it?

Start with pain points. Seniors face daily frustrations that younger people don't even notice. Packaging that won't open. Websites with tiny text. Customer service phone trees. Products that assume perfect vision, hearing, and dexterity. Every frustration is an opportunity.

Build for dignity, not disability. The fastest way to fail in this market is making people feel old. Products that enhance capability, preserve independence, and respect intelligence win. Medical aesthetics matter. So does user experience. Design like you're building for yourself in 30 years.

Solve family problems, not just senior problems. Adult children managing aging parents are desperately seeking solutions. Platforms that coordinate care, facilitate financial oversight, and enable communication across generations serve multiple customers simultaneously.

Think decades, not quarters. Customer lifetime value in the longevity economy can span 30 years. Seniors who find products they trust become fiercely loyal. They're not chasing trends. Build for retention, not acquisition.

Partner, don't reinvent. The regulatory complexity, domain expertise, and distribution challenges in this market favor partnerships. Find established players who need innovation, or innovative startups who need scale.

Go where the money is. Senior spending statistics show people 75-plus actually spend more annually than those 65-74 in many categories. The oldest old aren't broke and declining. They're wealthy and active.

Invest in education. Seniors adopt technology when they understand it. Companies that invest in customer education, intuitive design, and actual human support will capture market share from those that don't.

Watch Japan, copy Nordic countries. Japan shows what happens at demographic extremes. Nordic countries show what works with proper social support. Both offer lessons applicable elsewhere.

Don't forget emerging markets. China's senior population will exceed the entire US population. India is aging rapidly. Emerging markets offer scale, but require different approaches, price points, and cultural sensitivity.

Track the wealth transfer. The $84 trillion shift creates opportunities at both ends. Serve boomers spending down assets, and millennials inheriting them.

Twenty years from now, we'll look back at 2025 the way we now view 1990: a world that seems almost unrecognizable in its youth obsession and age denial. The longevity economy isn't coming. It's here.

Companies built today will shape how billions age over the coming decades. They'll determine whether we age with dignity, independence, and purpose, or whether we marginalize and warehouse our elders the way we've done for generations.

The economic opportunity is measured in trillions. The social impact is immeasurable.

The question isn't whether to participate in the longevity economy. If you're in business, you're already participating, whether you realize it or not. The question is whether you're going to lead this transformation or get disrupted by it.

Demographics don't lie. The wave is coming. Build your surfboard.

Ahuna Mons on dwarf planet Ceres is the solar system's only confirmed cryovolcano in the asteroid belt - a mountain made of ice and salt that erupted relatively recently. The discovery reveals that small worlds can retain subsurface oceans and geological activity far longer than expected, expanding the range of potentially habitable environments in our solar system.

Scientists discovered 24-hour protein rhythms in cells without DNA, revealing an ancient timekeeping mechanism that predates gene-based clocks by billions of years and exists across all life.

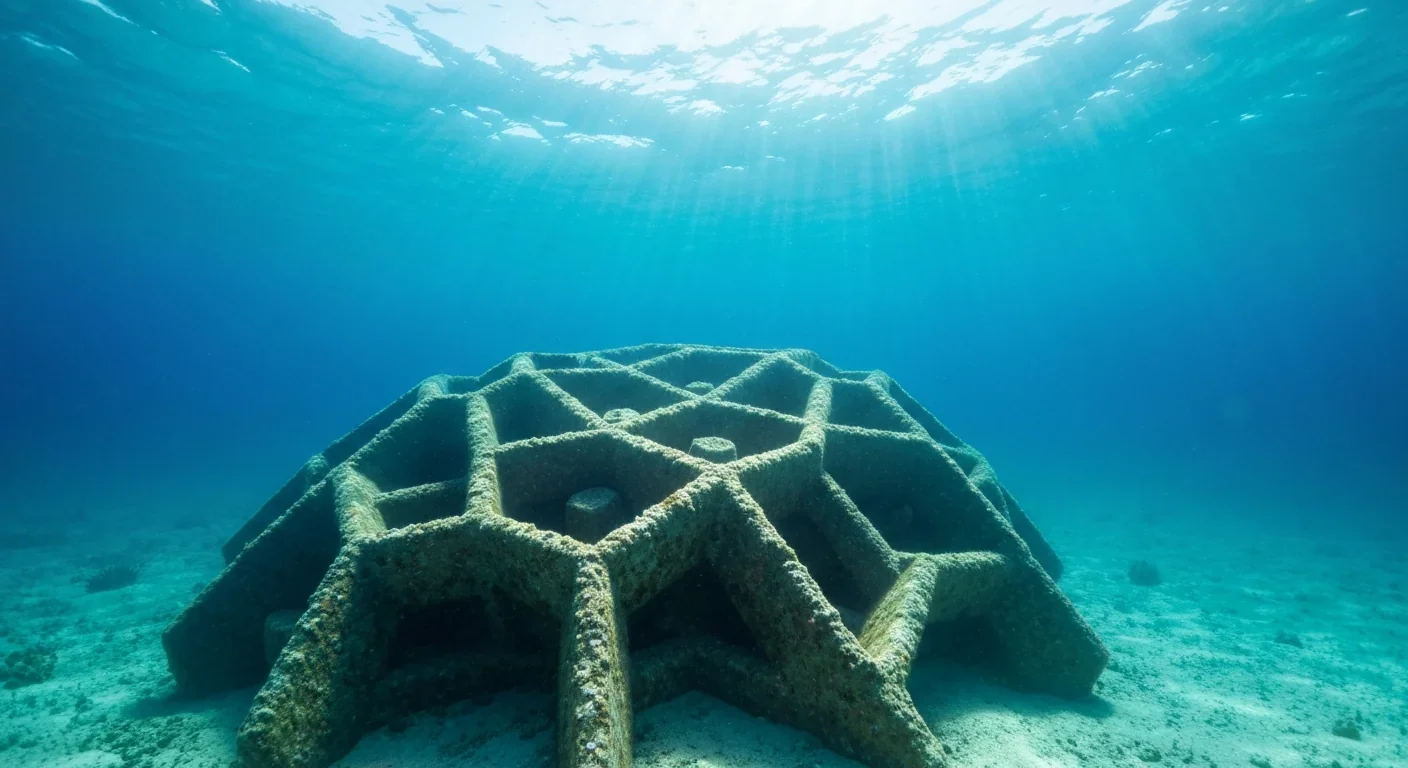

3D-printed coral reefs are being engineered with precise surface textures, material chemistry, and geometric complexity to optimize coral larvae settlement. While early projects show promise - with some designs achieving 80x higher settlement rates - scalability, cost, and the overriding challenge of climate change remain critical obstacles.

The minimal group paradigm shows humans discriminate based on meaningless group labels - like coin flips or shirt colors - revealing that tribalism is hardwired into our brains. Understanding this automatic bias is the first step toward managing it.

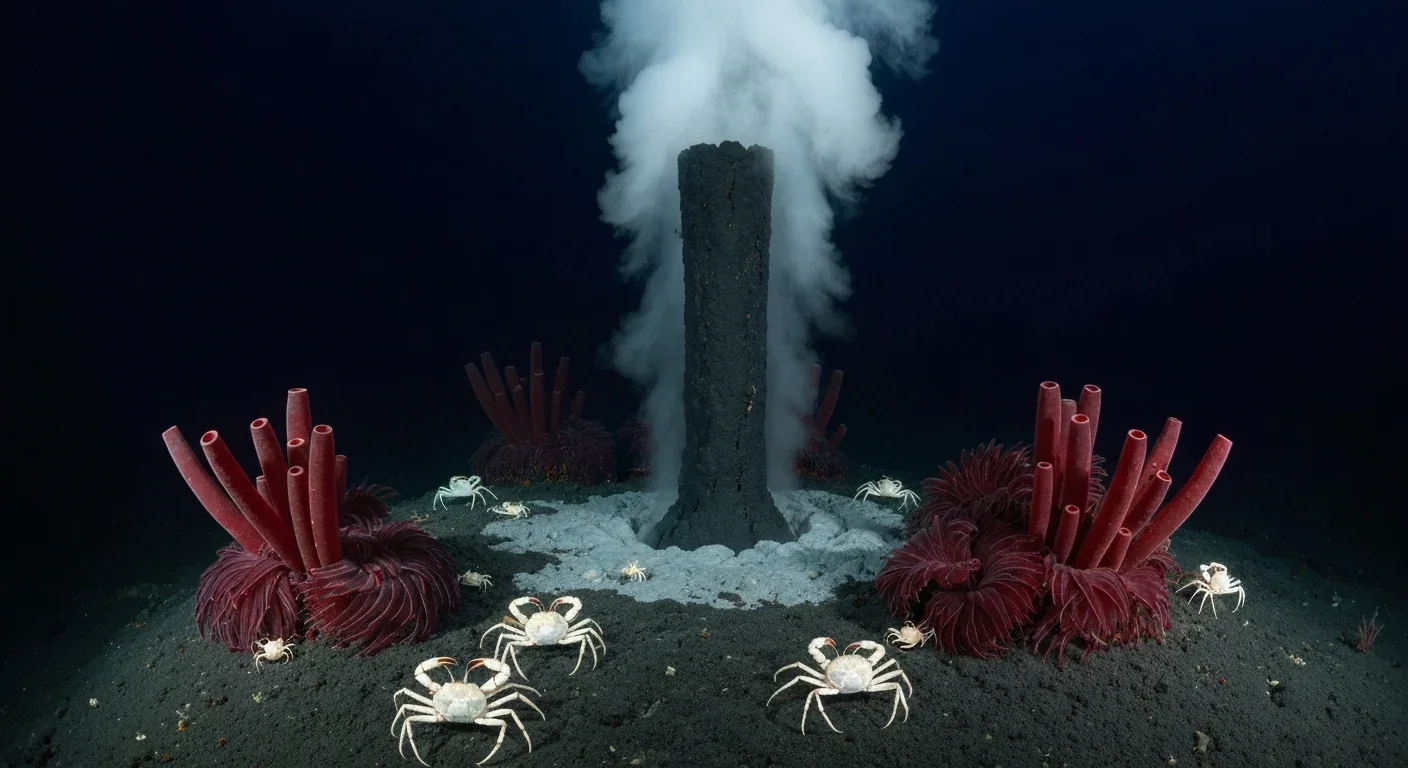

In 1977, scientists discovered thriving ecosystems around underwater volcanic vents powered by chemistry, not sunlight. These alien worlds host bizarre creatures and heat-loving microbes, revolutionizing our understanding of where life can exist on Earth and beyond.

Automated systems in housing - mortgage lending, tenant screening, appraisals, and insurance - systematically discriminate against communities of color by using proxy variables like ZIP codes and credit scores that encode historical racism. While the Fair Housing Act outlawed explicit redlining decades ago, machine learning models trained on biased data reproduce the same patterns at scale. Solutions exist - algorithmic auditing, fairness-aware design, regulatory reform - but require prioritizing equ...

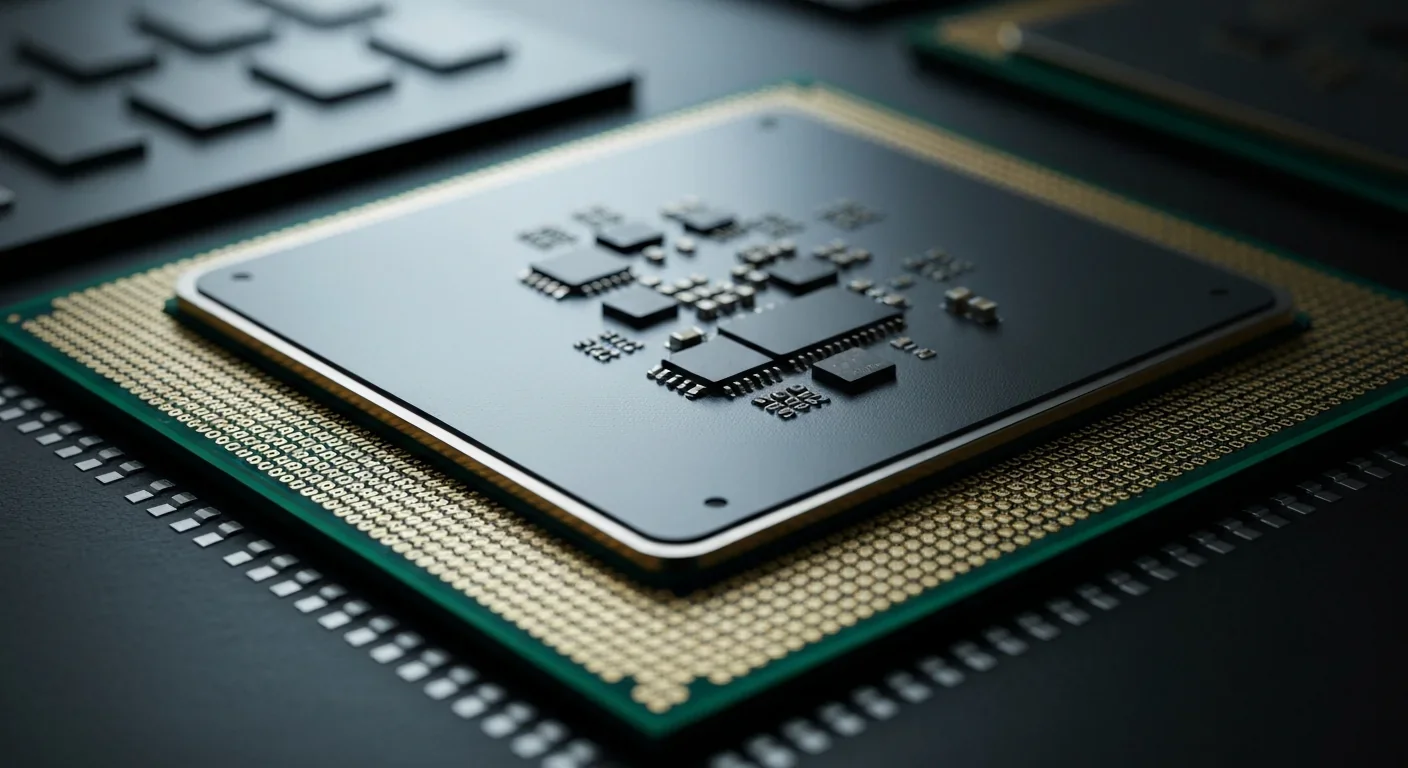

Cache coherence protocols like MESI and MOESI coordinate billions of operations per second to ensure data consistency across multi-core processors. Understanding these invisible hardware mechanisms helps developers write faster parallel code and avoid performance pitfalls.